- State of the Screens

- Posts

- TV Turmoil: Networks Work To Adapt To New Normal

TV Turmoil: Networks Work To Adapt To New Normal

Big question: Are better days ahead for Madison Avenue?

Quick answer: Unclear. The advertising industry was already facing headwinds (changing consumer behavior, trust, etc.), exasperated by COVID-19.

National broadcast and cable TV ad revenue (YoY change) according to Variety:

1) 2018-Q2 – $11.5B

2) 2019-Q2 – $11.7B (↑ 2%)

3) 2020-Q2 – $8.6B (↓ 27%)

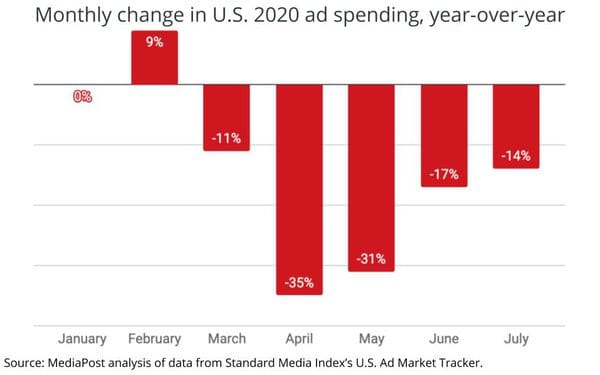

YoY change in monthly U.S. ad spend according to Standard Media Index:

1) Jan-20 – ↑ 2%

2) Feb-20 – ↑ 9%

3) Mar-20 – ↓ 11%

4) Apr-20 – ↓ 35%

5) May-20 – ↓ 31%

6) Jun-20 – ↓ 17%

7) Jul-20 – ↓ 14%

Quote from Shari Cohen – Former Senior Buying Executive @ GroupM:

“It is really hard to be a sales organization and go in every Monday and have all of this inventory to sell and not know where the demand is coming from each week”

Top 3 industries based on difference in TV ad spend according to iSpot:

1) Politics – ↑ $517M

2) Home & Real Estate – ↑ $336M

3) Health & Beauty – ↑ $129M

Bottom 3 industries based on difference in TV ad spend:

1) Automotive – ↓ $1.2B

2) Electronics – ↓ $720M

3) Travel – ↓ $711M

The post TV Turmoil: Networks Work To Adapt To New Normal appeared first on Cross Screen Media.

Reply