- State of the Screens

- Posts

- Sports betting short term pain could be long term gain

Sports betting short term pain could be long term gain

Sports betting on NCAA March Madness (YoY growth) according to the American Gaming Association:

1) 2019 – $8.5B

2) 2020P – $10.0B (↑ 18%)

Quote from Chris Ripley – CEO @ Sinclair Broadcast Group:“Sports betting we think will have large new revenue pools associated with them. We think ultimately they will be bigger than advertising — not as big as subscriptions — but it also helps viewership, which helps advertising and viewership, which helps you with your MVPD negotiations…”

Estimated sports betting wagers (YoY growth) according to Activate Consulting:

1) 2017 – $5B

2) 2018 – $7B (↑ 40%)

3) 2019P – $13B (↑ 86%)

4) 2020P – $31B (↑ 138%)

5) 2021P – $63B (↑ 103%)

6) 2022P – $102B (↑ 62%)

7) 2023P – $149B (↑ 46%)

What the future could look like with betting information integrated into the game itself.

Why this matters: Nielsen estimates that TV rights fees will increase by 18%, and 32% of NFL bets are placed during the game.

Quote from Scott Warfield – Managing Director of Gaming @ Nascar:“If we can get our fans to watch for another 15, 30, 45 minutes, obviously, what does that do for Nielsen ratings and then our next TV negotiations in ’23, ’24?…It’s all about engagement.”

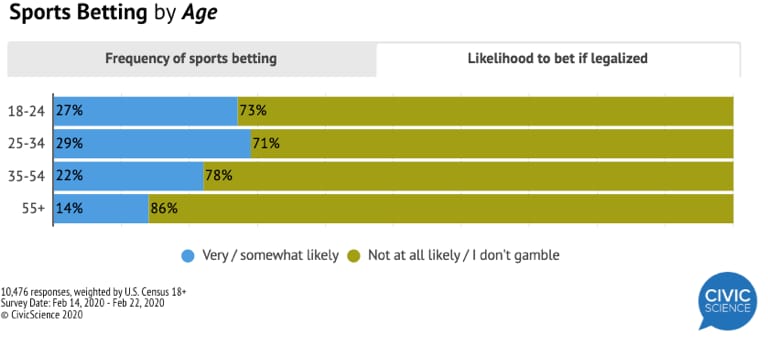

Interest in sports betting if legalized according to Civic Science:

1) 25-34 – 29%

2) 18-24 – 27%

3) 35-54 – 22%

4) 55+ – 14%

5) 18+ – 21%

The post Sports betting short term pain could be long term gain appeared first on Cross Screen Media.

Reply